Sustainability

Status of response to TCFD/TNFD recommendations

Recognizing that ESG (Environment, Social, Governance) is extremely important for improving corporate value over the medium to long term, the Group has disclosed about the TCFD (Task Force on Climate-related Financial Disclosures) and TNFD (Task Force on Nature-Related Financial Disclosures). Based on the recommendations, we disclose the risks and opportunities for each risk item related to climate change and biodiversity, the degree of impact on business, and the Group's response.

Additionally, we have joined the Climate Change Initiative (JCI)*, which was established to strengthen the dissemination of information and exchange of opinions among various non-state actors such as companies, local governments, and NGOs that are actively working on climate change countermeasures. We joined in March 2023 and announced our support for the TCFD recommendations in May 2023.

Click here for details on the Climate Change Initiative (JCI) *

Governance

Our group has established a Sustainability Committee with the aim of strengthening corporate governance functions in order to achieve sustainable growth based on our management philosophy. This committee will play a central role in setting and reviewing important issues and related goals, monitoring progress, and other social issues, including ESG, SDGs, Society 5.0, climate change, and other environmental issues, as well as diversity and inclusion. We evaluate, review business portfolios, and decide on medium- to long-term management plans and direction. We also recognize that responding to climate change and natural capital is an important management issue, and based on the discussions of each internal committee, activity reports, and policy recommendations, the Board of Directors meets from time to time to comprehensively deliberate, and decisions are being made.

Strategy

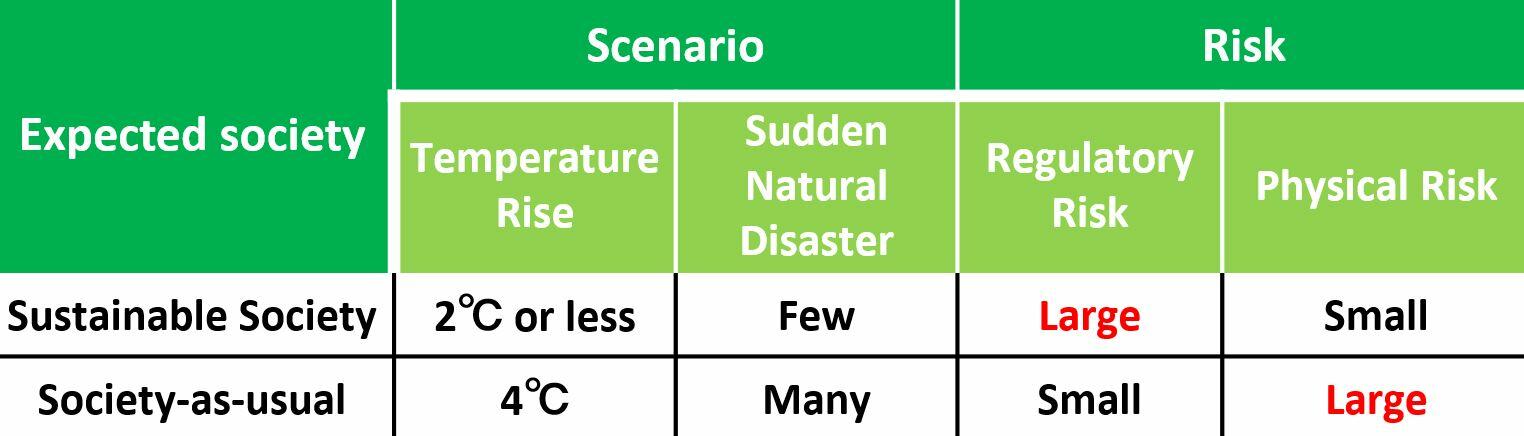

The Group's Fifth Medium-Term Five-Year Business Execution Plan sets a vision for what it wants to be in 2030, and assumes scenarios of temperature increase 2℃ or less and 4℃ in 2030, and takes important physical measures related to climate change and natural capital. We recognize multiple risks, transition risks, and opportunities. We referred to the global warming scenarios (RCP2.6-8.5, SSP1-8.5) from the IPCC Fifth and Sixth Assessment Reports, the 1.5℃ Special Report, and the IEA World Energy Outlook, TNFD Final Recommendation. We evaluated the importance of climate change-related risks and opportunities and identified them as "material risks'' from the perspective of urgency (timing of manifestation) and degree of impact on business. Regarding risks and opportunities related to natural capital, we used the LEAP approach* to confirm our dependence on and impact on natural capital in our business activities.

*LEAP approach: (Locate)Discover points of contact with nature, (Evaluate)Diagnose dependencies and impacts, (Assess)Assess risks and opportunities ,(Prepare)Prepare to respond to nature-related risks and opportunities, and report to investors. A method of prioritizing impacts and measures on natural capital by focusing on location.

We calculate the amount of impact on revenue if a high-priority risk event among the identified material risks occurs in 2030, and show the degree of impact.

As a result of the scenario analysis, we reaffirm the following two points, which we have already undertaken.

・Reducing CO₂ emissions and increasing sustainable procurement rates for climate change.

・Diversifying rosin sources for natural capital.

We have reconfirmed that it is possible to reduce the impact on our business and supply chain by taking appropriate actions to address the Circular Economy and to achieve the targets of the KIZUNA Index.

We will increase awareness of anticipated risks and opportunities from a medium- to long-term perspective, and link this to the planning and execution of strategies, including time horizons.

*1 Short-term: 0-3 years, Medium-term: 3-10 years, Long-term: 10-30 years

*2 The impact on sales revenue is evaluated in three levels: large (1 billion yen), medium (hundreds of millions of yen), and small

(less than 100 million yen).

Risk management/Risk and impact management

Our group conducts its corporate activities from a long-term perspective through environmental, social, and governance management. We have formulate materiality (important issues) from the perspective of interest and impact on all stakeholders, including the global environment and society, as well as our group priority. In addition, we have identified 12 priority issues to be addressed and promoting activities with KIZUNA index. Regarding climate change, we believe that reducing CO₂ emissions through business activities, paying attention to the environment, and contributing to solving social issues are of high importance, and we have set numerical targets listed in " Metrics and goals" Regarding company-wide risks, including risks related to climate change and natural capital, the Risk Management Specialist Committee plays a central role under the Risk Management and Compliance Committee, and conducts periodic risk management (listing priority risks and managing the progress of countermeasures) and We are working to strengthen risk assessment.

Metrics and goals

●Response to climate change

We have selected [Reduction of CO₂ emissions] and [Consolidated sales index of sustainability products] as KIZUNA indicators related to responding to climate change, and are managing progress. This indicator is linked to the Group's medium-term environmental and safety goals and KPIs for Sustainability Link Bonds.

Click here for details on Sustainability Link Bonds

●Responding to natural capital

The theme of TNFD is biodiversity, which is broader than climate change and involves all kinds of factors. However, our group's business is highly dependent on rosin, a sustainable recycled raw material, and has a negative impact on natural capital. As an initiative to reduce impacts and lead to positive impacts, we have set the KIZUNA index [Matsutarou Forest Afforestation Activities and CO₂ Absorption Evaluation] [Biomass Conversion Sales Volume Index] as a management indicator.

Items to be considered for future disclosure

In the future, we will improve the accuracy of verifying the financial impact, and we will gradually disclose risk items that have been insufficiently evaluated while making appropriate adjustments. Regarding TCFD, we will work to understand Scope 3 and set targets for reducing greenhouse gas emissions in our group's supply chain. Furthermore, although the current LEAP approach for TNFD does not cover all business activities, the rosin-related business will continue to be an important core business for our company in order to realize a sustainable society. We will continue to examine the impact on our business and natural capital, including from a regional perspective, such as the conservation of pine species and measures tailored to the country and region in which pine resin is collected.